Dubai’s realty market has eons been a magnet for global investors. The expats attracted to the UAE from nearly all corners of the world ought to know about the laws of real estate, which are quite a priority, lest make investments correctly and ensure the rights of the property.

1. Freehold Property Ownership Law

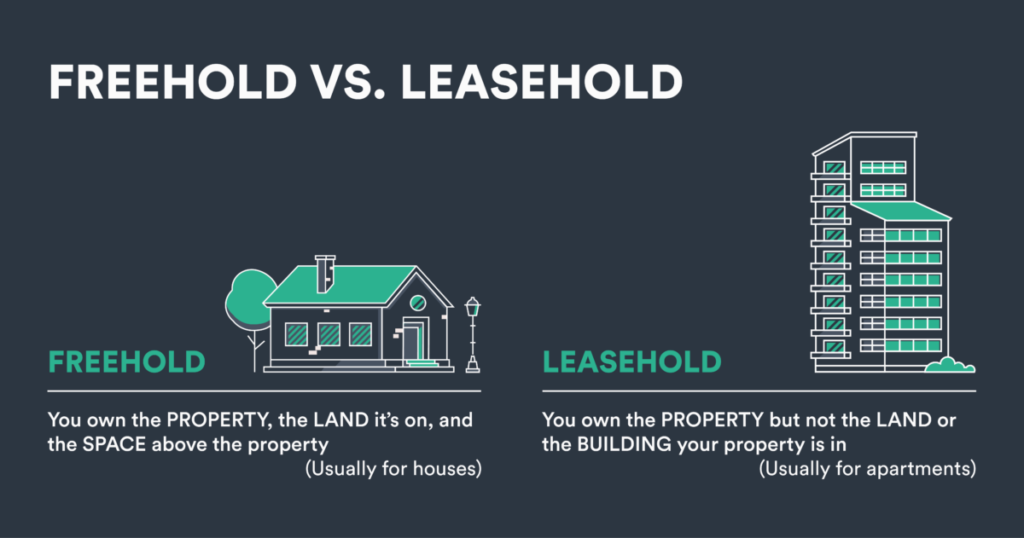

Expats are permitted to buy freehold properties only in designated areas which have government approval. These include freehold zones within significant areas such as Downtown Dubai, Palm Jumeirah, and Dubai Marina. Such ownership in these zones grants full rights to buy, sell, and lease the property. It is possible for foreigners to register their ownership with the Dubai Land Department (DLD), and typically properties are registered in the individual’s name or that of a company.

The registration fee is charged at 4% of the property’s value.Another benefit of owning freehold property in Dubai is the way an owner can lease it: long-term and short-term rentals can both generate income. Furthermore, buyers should take into account service charges and maintenance costs, which are dependent on the property type and location. It also guarantees long-term security and flexibility; however, investors should conduct a proper survey of property developers and market trends of the area they wish to buy into.

2. Strata Law (Jointly Owned Property Law)

The Strata Law regulates the management of jointly owned properties, which can include apartments and communities. It requires bylaw the formation of Owners Associations (OAs) to attend to the maintenance and management of common areas. The law requires the strictest accountability of developers for assuring that the areas of community are well maintained and that hence, service charge and maintenance costs are highly transparent. The moment expatriates buy properties within these communities, they become part and parcel of the OA and are therefore tasked with paying service fees.Owners Associations essentially contribute towards maintaining the value of property and addresses the upkeep of shared facilities – swimming pools, gyms, and grounds etc.

The service charge can vary greatly depending on the type of property and the location; thus, potential buyers should add that into their investment calculation. Regular meetings and open communications between OA members will also help settle issues about property management and maintenance.

3. Tenancy Law

The UAE’s Tenancy Law regulates the relationship between landlords and tenants to protect both parties in the contract. The Dubai Rental Dispute Settlement Centre (RDSC) looks after disputes that arise out of lease agreements, rent increases, and eviction notices. Landlords cannot raise their rents in an arbitrary manner since the RERA imposes various caps on rental increases based upon geographical stretches and current rent rates.

Tenants are advised to study contracts of rental carefully and know their rights, chiefly against eviction and extension.Further, it is very important for landlords that in case they wish to increase the rent upon renewal of a lease, they give prior notice of 90 days to the concerned person; thus, allowing that person to dispute any unjustified increase. Also, the law allows a notice given for eviction to be declared only after 12 months – this ensures ample notice for the tenants to arrange accordingly. Knowing these laws and regulations can help expatriates avoid disputes and protect their rental rights.

4. Mortgage Law

The mortgage laws in the UAE define how money will be lent to property purchasers by financial institutions. The maximum LTV ratio permitted for expat buyers is usually 80% for first-time buyers and is lower for subsequent property purchases. Have to register the mortgage with DLD, usually at 0.25% of the loan amount.

In case of default, the lender may initiate foreclosure proceedings, but this would all have to be done through the courts to safeguard due legal process.Every expat looking for property must consult terms and conditions, interest rates, fixed or variable rate, and penalties for early repayments. Advice from a mortgage advisor can help buyers get the absolute best out of their terms and understand what commitment they’ll shoulder in the end financially. Besides, lenders will also require that one has an all-risk insurance for the property, thus increasing the total amount to be paid for ownership.

5. Inheritance and succession law

For expats, the laws of Sharia dictate real estate inheritance unless a non-Muslim draws up a will in Dubai Courts or the DIFC Wills Service Center. Without a will, property distribution will not be in accordance with the wishes of the deceased person; being based on Sharia, his property would be divided according to the principles of this legal system.

If property owners wish their rights of inheritance to be enforced, expats should possess a will that has been registered in the UAE to avoid messy succession оформления.The rendering of an estate will be done through the execution and rudimentary instruction of a will, which, when legally binding, leaves no room for arguments about which beneficiaries own real estate properties. Furthermore, collaborating with legal experts who know UAE inheritance law can ensure minimal legal complications and seamless asset transfer.

Conclusion

As in any part of the world, real estate can have its challenges for expats wanting to settle in the UAE; however, knowing these basic rules can be really helpful. Hiring an experienced property lawyer is, therefore, strongly recommended to comply with and to protect your investment.

No matter whether you are buying, renting, or letting out a property, you will feel confident and act on informed advice. The Dubai real estate market is constantly evolving, and one must always stay updated with the recent laws to guide wise investment choices. To stay on top of the changes, expats should constantly consult reliable property advisors and legal consultants who will be able to help them safeguard their investments.